Free Ideas For Picking Crypto Trading

What Are The Primary Factors That Determine Rsi Divergence

Definition: RSI diversence is a technical analytical tool that compares the price of an asset to the direction it has relative strength (RSI).

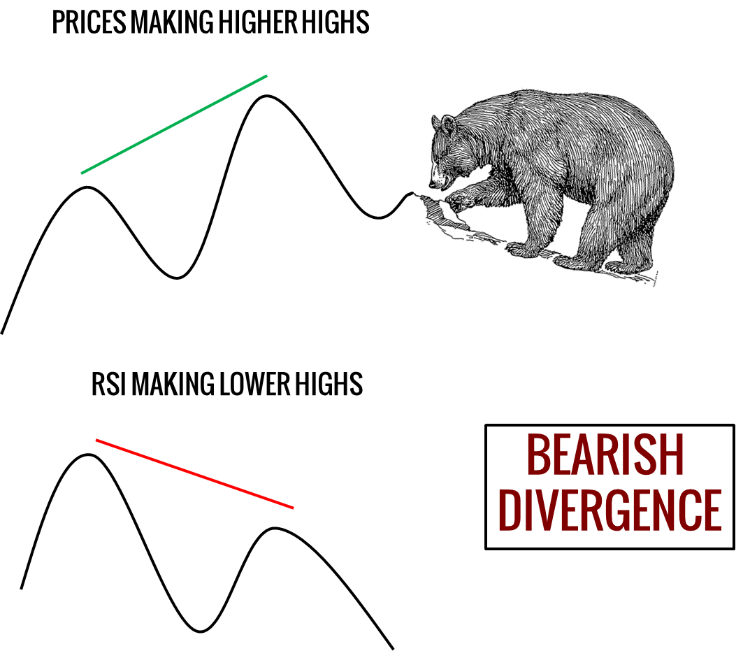

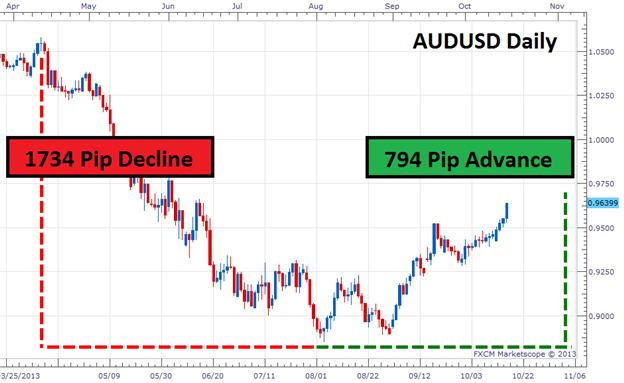

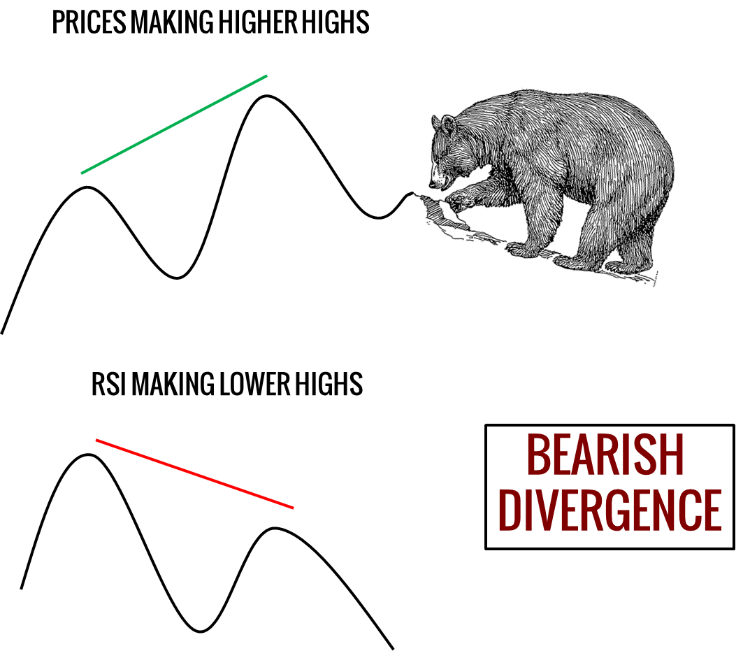

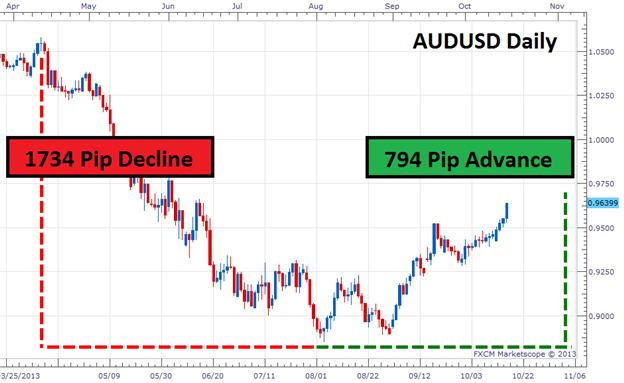

Signal: Positive RSI divergence indicates an upward signal. Negative RSI divergence is an indication of bearishness.

Trend Reversal: RSI Divergence can signal an inverse trend.

Confirmation - RSI divergence should be used in conjunction with other analysis techniques.

Timeframe: RSI divergence is possible to be viewed over different timeframes in order to gain different perspectives.

Overbought/Oversold RSI values above 70 indicate an overbought condition. Values below 30 mean that the market is undersold.

Interpretation: To comprehend RSI divergence in a precise manner requires the taking into account additional fundamental or technical aspects. Have a look at the most popular automated forex trading for blog tips including crypto trading bot, position sizing calculator, automated crypto trading, trading platform, forex backtesting software, crypto trading, trading platform crypto, forex backtesting software, cryptocurrency trading bot, cryptocurrency trading and more.

What's The Difference Between Regular Divergence And Hidden Divergence?

Regular Divergence: A price swing that can cause an asset to make an upper high/lower low, and for the RSI to make a lower high/lower low is referred to as regular divergence. It can indicate a potential trend reversal, but it is important to consider other fundamental and technical factors to provide confirmation.Hidden Divergence: Hidden divergence occurs when the price of an asset makes a lower high or a higher low while the RSI is able to make higher highs or lower low. It is considered to be a less reliable signal than normal divergence but it can still indicate the possibility of a trend reverse.

Consider technical aspects

Trend lines and support/resistance indexes

Volume levels

Moving averages

Other indicators and oscillators

The most important aspects to be considered:

Economic data

Details specific to your company

Market sentiment and sentiment indicators

Global events and the impact of markets

It's essential to look at both technical and fundamental factors before making investment decisions that are based on RSI divergence signals. Check out the recommended crypto backtesting for site tips including backtesting, forex backtesting, backtesting trading strategies, automated crypto trading, forex backtesting, backtester, forex backtester, crypto trading backtesting, crypto trading bot, best trading platform and more.

What Are Backtesting Techniques For Trading Crypto

Backtesting trading strategies in crypto trading is the process of simulated application of a trading strategy by using historical data to evaluate its possible profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy - Explain the trading strategy being used that includes rules for withdrawal and entry, position size, and rules of risk management.

Simulator: This program simulates the execution of a trading plan using historical data. This allows you see how the strategy would have been performing over time.

Metrics: Assess the efficacy of the strategy by using metrics like profitability and Sharpe ratio, drawdown, and other measures that are relevant.

Optimization: Tweak the parameters of the strategy and then repeat the simulation until you are able to improve the strategy's performance.

Validation: Verify the effectiveness of the strategy on outside-of-sample data to confirm its robustness and prevent overfitting.

It is important to remember that past performance can never be used to determine the likelihood of the future's performance. Results from backtesting should not ever be relied upon to predict future profits. Also, live trading requires you to take into account the consequences of fluctuations in the market transactions fees, market volatility, and other aspects of the real world. See the best trading divergences for site info including backtester, divergence trading, forex backtesting software, backtesting strategies, crypto trading bot, backtesting trading strategies, crypto trading, best crypto trading platform, crypto trading bot, automated trading software and more.

How Can You Assess Forex Backtest Software For Trading Using Divergence?

When you are looking into forex backtesting software, ensure that it is able to access past data on the forex pairs being trades.

Flexibility The flexibility of RSI divergence strategies for trading are able to be modified and tested using the software.

Metrics : The software should include a range o metrics that can be used to evaluate the effectiveness of RSI Divergence Strategies for Trading, including profit, risk/reward, and drawdown.

Speed: Software must be quick and efficient, in order to enable multiple strategies to be quickly tested back.

User-Friendliness. The software should be user-friendly and simple to comprehend, even for those with little technical analysis background.

Cost: You need to be aware of the cost of the program to determine if it's within your financial budget.

Support: Software should offer good customer service, including tutorials and technical assistance.

Integration: The software needs to integrate with other trading software , such as charting programs or trading platforms.

It is important to test the software with an account with a demo before you purchase an annual subscription. This lets you verify that the software meets your requirements and you are comfortable using the software. Check out the most popular divergence trading forex for website info including RSI divergence cheat sheet, backtesting strategies, automated trading software, position sizing calculator, cryptocurrency trading bot, automated forex trading, backtesting trading strategies, crypto trading backtester, divergence trading, automated crypto trading and more.

What Are The Functions Of Automated Trading Software's Cryptocurrency Trading Bots Function?

A set of pre-defined rules is followed by cryptocurrency trading robots, which execute trades for the user. This is how it works: Trading method: The customer chooses the plan of trading, which includes the criteria for entry and exit as well as position sizing, risk management and risk management.

Integration: The bot for trading is integrated with a cryptocurrency exchange through APIs that allow it to connect to real-time market data and make trades.

Algorithm : This bot employs algorithms to analyze market trends and make trading decisions based on an established strategy.

Execution – The bot executes trades in accordance with the trading strategy, and does so without any manual intervention.

Monitoring: The robot watches the market on a regular basis and adjusts its trading strategy to reflect this. See the most popular trading divergences for site tips including best trading platform, automated forex trading, stop loss, backtesting, crypto backtesting, forex backtesting software free, automated trading software, forex tester, automated trading software, trading platforms and more.

A robot for trading in cryptocurrency can aid you in the execution of complicated or repetitive strategies. Automated trading is not without risk. It is susceptible to security and software bugs, vulnerabilities, or lose control over the trading decisions. It is crucial to thoroughly analyze and evaluate any trading robot before using it for live trading.

Definition: RSI diversence is a technical analytical tool that compares the price of an asset to the direction it has relative strength (RSI).

Signal: Positive RSI divergence indicates an upward signal. Negative RSI divergence is an indication of bearishness.

Trend Reversal: RSI Divergence can signal an inverse trend.

Confirmation - RSI divergence should be used in conjunction with other analysis techniques.

Timeframe: RSI divergence is possible to be viewed over different timeframes in order to gain different perspectives.

Overbought/Oversold RSI values above 70 indicate an overbought condition. Values below 30 mean that the market is undersold.

Interpretation: To comprehend RSI divergence in a precise manner requires the taking into account additional fundamental or technical aspects. Have a look at the most popular automated forex trading for blog tips including crypto trading bot, position sizing calculator, automated crypto trading, trading platform, forex backtesting software, crypto trading, trading platform crypto, forex backtesting software, cryptocurrency trading bot, cryptocurrency trading and more.

What's The Difference Between Regular Divergence And Hidden Divergence?

Regular Divergence: A price swing that can cause an asset to make an upper high/lower low, and for the RSI to make a lower high/lower low is referred to as regular divergence. It can indicate a potential trend reversal, but it is important to consider other fundamental and technical factors to provide confirmation.Hidden Divergence: Hidden divergence occurs when the price of an asset makes a lower high or a higher low while the RSI is able to make higher highs or lower low. It is considered to be a less reliable signal than normal divergence but it can still indicate the possibility of a trend reverse.

Consider technical aspects

Trend lines and support/resistance indexes

Volume levels

Moving averages

Other indicators and oscillators

The most important aspects to be considered:

Economic data

Details specific to your company

Market sentiment and sentiment indicators

Global events and the impact of markets

It's essential to look at both technical and fundamental factors before making investment decisions that are based on RSI divergence signals. Check out the recommended crypto backtesting for site tips including backtesting, forex backtesting, backtesting trading strategies, automated crypto trading, forex backtesting, backtester, forex backtester, crypto trading backtesting, crypto trading bot, best trading platform and more.

What Are Backtesting Techniques For Trading Crypto

Backtesting trading strategies in crypto trading is the process of simulated application of a trading strategy by using historical data to evaluate its possible profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy - Explain the trading strategy being used that includes rules for withdrawal and entry, position size, and rules of risk management.

Simulator: This program simulates the execution of a trading plan using historical data. This allows you see how the strategy would have been performing over time.

Metrics: Assess the efficacy of the strategy by using metrics like profitability and Sharpe ratio, drawdown, and other measures that are relevant.

Optimization: Tweak the parameters of the strategy and then repeat the simulation until you are able to improve the strategy's performance.

Validation: Verify the effectiveness of the strategy on outside-of-sample data to confirm its robustness and prevent overfitting.

It is important to remember that past performance can never be used to determine the likelihood of the future's performance. Results from backtesting should not ever be relied upon to predict future profits. Also, live trading requires you to take into account the consequences of fluctuations in the market transactions fees, market volatility, and other aspects of the real world. See the best trading divergences for site info including backtester, divergence trading, forex backtesting software, backtesting strategies, crypto trading bot, backtesting trading strategies, crypto trading, best crypto trading platform, crypto trading bot, automated trading software and more.

How Can You Assess Forex Backtest Software For Trading Using Divergence?

When you are looking into forex backtesting software, ensure that it is able to access past data on the forex pairs being trades.

Flexibility The flexibility of RSI divergence strategies for trading are able to be modified and tested using the software.

Metrics : The software should include a range o metrics that can be used to evaluate the effectiveness of RSI Divergence Strategies for Trading, including profit, risk/reward, and drawdown.

Speed: Software must be quick and efficient, in order to enable multiple strategies to be quickly tested back.

User-Friendliness. The software should be user-friendly and simple to comprehend, even for those with little technical analysis background.

Cost: You need to be aware of the cost of the program to determine if it's within your financial budget.

Support: Software should offer good customer service, including tutorials and technical assistance.

Integration: The software needs to integrate with other trading software , such as charting programs or trading platforms.

It is important to test the software with an account with a demo before you purchase an annual subscription. This lets you verify that the software meets your requirements and you are comfortable using the software. Check out the most popular divergence trading forex for website info including RSI divergence cheat sheet, backtesting strategies, automated trading software, position sizing calculator, cryptocurrency trading bot, automated forex trading, backtesting trading strategies, crypto trading backtester, divergence trading, automated crypto trading and more.

What Are The Functions Of Automated Trading Software's Cryptocurrency Trading Bots Function?

A set of pre-defined rules is followed by cryptocurrency trading robots, which execute trades for the user. This is how it works: Trading method: The customer chooses the plan of trading, which includes the criteria for entry and exit as well as position sizing, risk management and risk management.

Integration: The bot for trading is integrated with a cryptocurrency exchange through APIs that allow it to connect to real-time market data and make trades.

Algorithm : This bot employs algorithms to analyze market trends and make trading decisions based on an established strategy.

Execution – The bot executes trades in accordance with the trading strategy, and does so without any manual intervention.

Monitoring: The robot watches the market on a regular basis and adjusts its trading strategy to reflect this. See the most popular trading divergences for site tips including best trading platform, automated forex trading, stop loss, backtesting, crypto backtesting, forex backtesting software free, automated trading software, forex tester, automated trading software, trading platforms and more.

A robot for trading in cryptocurrency can aid you in the execution of complicated or repetitive strategies. Automated trading is not without risk. It is susceptible to security and software bugs, vulnerabilities, or lose control over the trading decisions. It is crucial to thoroughly analyze and evaluate any trading robot before using it for live trading.