New Tips For Choosing Automated Trading

What Are The Factors To Be Considered When Taking A Look At Rsi Divergence

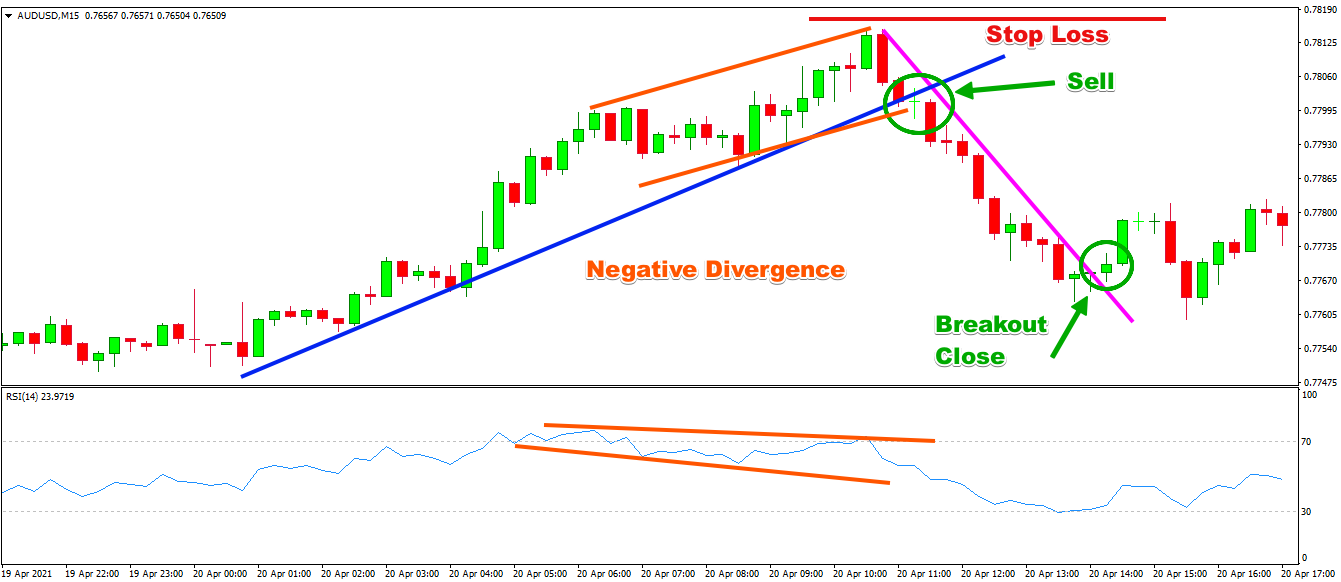

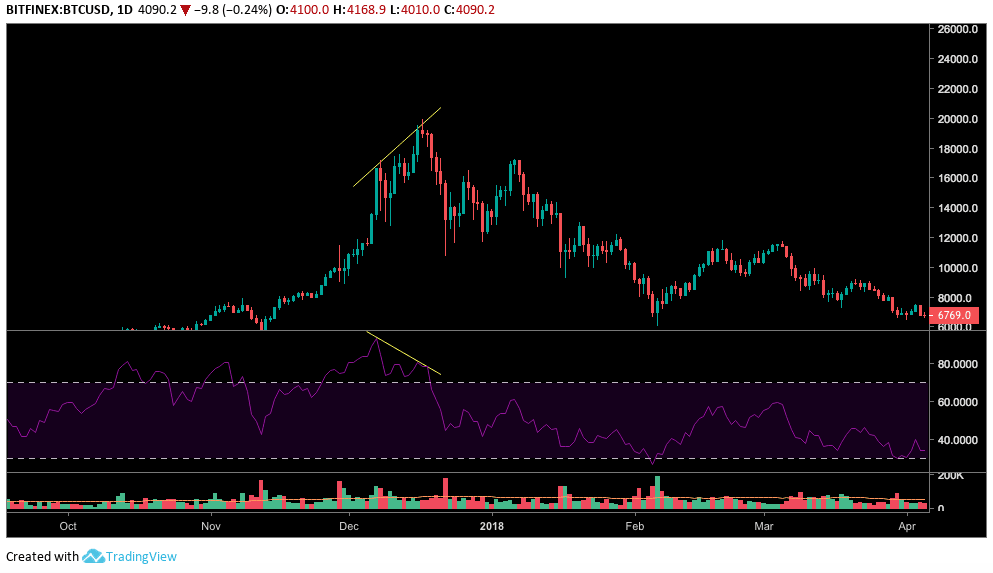

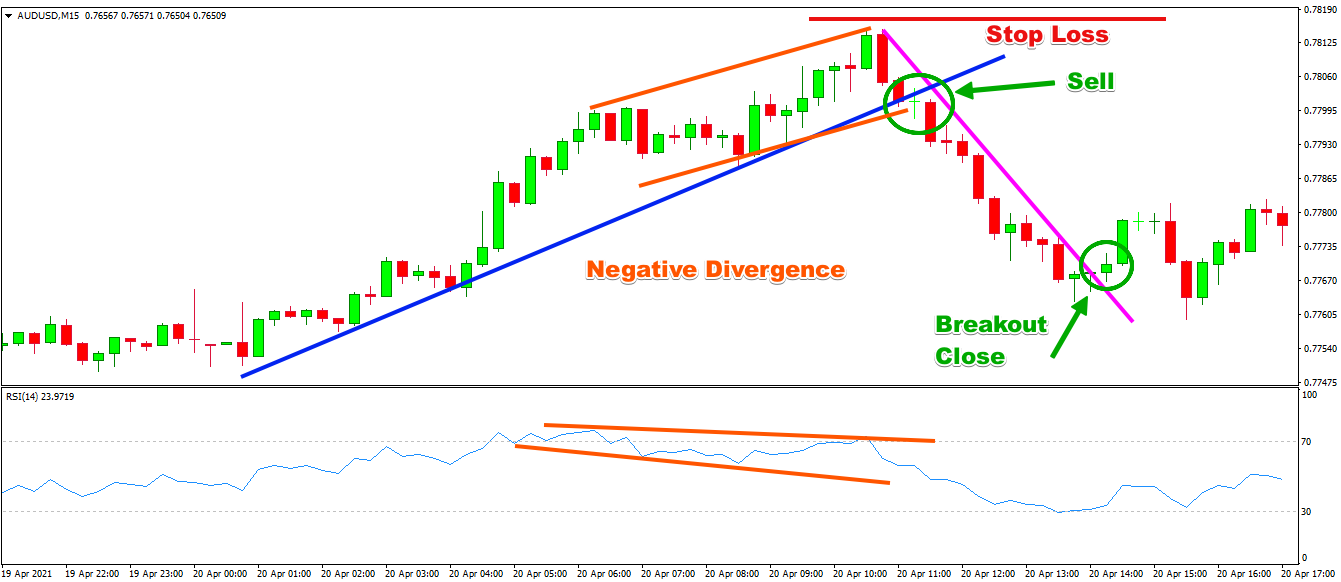

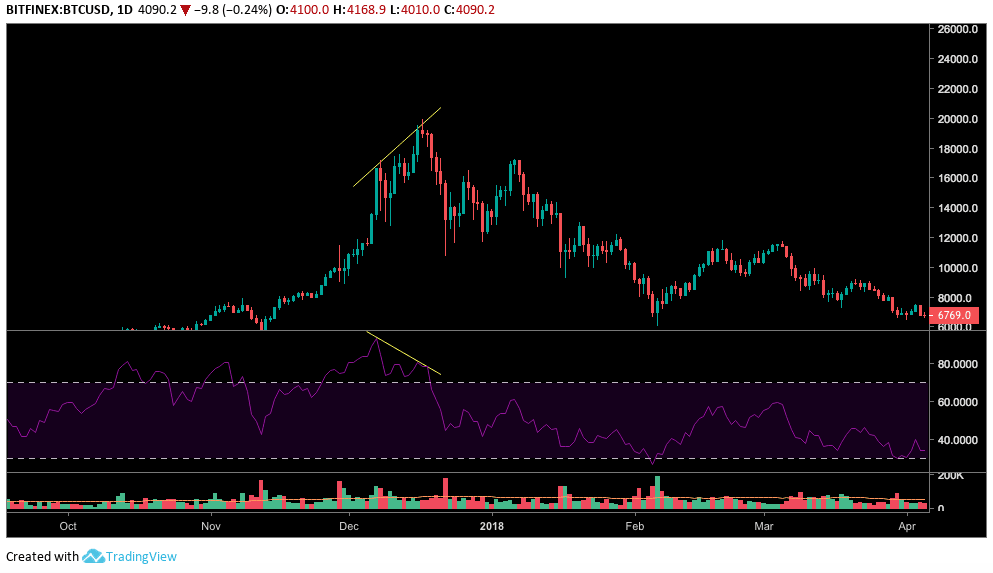

Definition: RSI diversence is a analytical tool that analyzes the direction that an asset's prices move in relation to the index of relative strength (RSI).

Signal Positive RSI divergence is seen as a bullish signal, while the opposite of a negative RSI divergence is seen as bearish.

Trend Reversal: RSI Divergence can signal an inverse trend.

Confirmation: RSI divergence can be utilized as a confirmation tool when used in conjunction with other analysis methods.

Timeframe: RSI divergence may be observed at various dates to gain different insight.

Overbought/Oversold RSI numbers that exceed 70 mean overbought, and values below 30 mean that the stock is oversold.

Interpretation: To interpret RSI divergence in a correct manner requires taking into account additional fundamental and technical aspects. Follow the top rated backtesting platform for site recommendations including forex tester, forex backtester, automated trading software, trading platform, cryptocurrency trading, crypto backtesting, forex trading, automated cryptocurrency trading, automated trading bot, best crypto trading platform and more.

What Is The Difference Between Regular Divergence Vs Hidden Divergence?

Regular Divergence: This occurs when the asset's price hits an upper or lower level than the RSI. It could signal the possibility of a trend reversal. But it is important to take into account the fundamental and technical aspects. Although this signal is not as powerful as regular divergence, it could still signal a possible trend reverse.

To be aware of the technical aspects:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other indicators of technical quality or oscillators

Take note of these essential aspects:

Economic data are released for release

Special news for businesses

Market sentiment and indicators of sentiment

Global developments and their impact on the market

It's essential to look at fundamental and technical aspects prior to making investment decisions that are based on RSI divergence signals. Check out the top rated online trading platform for website info including forex backtesting, backtesting platform, cryptocurrency trading bot, trading divergences, backtester, RSI divergence, trading with divergence, automated trading software, trading platform, trading platform cryptocurrency and more.

What Are The Backtesting Strategies For Trading Crypto

Backtesting crypto trading strategies is the practice of replicating the implementation of a trading plan using historical data. This allows you to assess the possibility of profit. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Explain the trading strategy that is currently being tested. This covers entry and exit rules and position sizing.

Simulator: This application allows you to simulate the implementation of a trading plan using historical data. This lets you see how the strategy would perform over time.

Metrics - Assess the strategy's performance using metrics such as Sharpe Ratio, Profitability drawdown, Sharpe Ratio, as well as other pertinent measures.

Optimization: Modify the strategy's parameters and run the simulation once more to improve the strategy's performance.

Validation: To ensure the method is dependable and avoid overfitting, verify its performance on data outside of sample.

Remember that past performance does not necessarily guarantee future results. Results from backtesting are not a guarantee of future profits. When applying the strategy to live trading, it's important to take into account the market's volatility, transaction costs, and other real-world considerations. Check out the most popular automated trading bot for more info including trading platforms, cryptocurrency trading, crypto backtesting, best trading platform, crypto backtesting, trading platform cryptocurrency, forex backtesting software free, crypto trading, position sizing calculator, crypto trading and more.

What Can You Do To Review The Forex Backtesting Software When Trading With Divergence

The following elements must be considered when evaluating forex backtesting programs to trade using RSI divergence. Data Accuracy: Ensure that the program has access to quality historical data for the forex pairs traded.

Flexible: The software should allow for customizing and testing of various RSI trading strategies for divergence.

Metrics : The program should include a range o metrics to evaluate the performance RSI Divergence Strategies for Trading, including the profitability, risk/reward and drawdown.

Speed: Software must be quick and efficient to enable rapid backtesting of different strategies.

User-Friendliness: The program should be user-friendly and easy to comprehend, even for people who do not have a deep understanding of technical analysis.

Cost: You should take a look at the cost of the program to determine if it is within your budget.

Support: You need good customer support. This includes tutorials and technical support.

Integration: The program should work well with other tools used in trading, such as trading platforms and charting software.

It's important to try out the software with the demo account prior to committing to a monthly subscription to ensure it's suited to your needs specifically and you're comfortable with the software. Check out the top position sizing calculator for website info including automated forex trading, crypto backtesting, best crypto trading platform, forex backtest software, cryptocurrency trading bot, backtesting platform, trading with divergence, divergence trading, backtesting strategies, crypto trading and more.

What Is The Process By Which Cryptocurrency Trading Software Bots Work?

A set of pre-determined rules are implemented by crypto trading robots which make trades for the user. Here's how it works. Trading Strategy: The user designs a trading strategy that includes entry and exit rules, the size of the position as well as risk management guidelines and risk management.

Integration: The robot for trading is integrated with a cryptocurrency platform through APIs. This lets it gain access to real-time market information and execute trades.

Algorithm: The bot employs algorithms to analyse market data and make decisions in accordance with the trading strategy.

Execution. The bot makes trades according to the trading strategy. It doesn't need manual intervention.

Monitoring The trading bot continually is monitoring and adapting to the market as necessary. Follow the top rated trading divergences for blog advice including bot for crypto trading, best trading platform, RSI divergence, forex backtest software, trading with divergence, forex tester, divergence trading, divergence trading forex, best crypto trading platform, forex backtesting software free and more.

Automated trading using cryptocurrency is extremely beneficial. They can execute complex and repetitive trading strategies, without the necessity of human intervention. They also allow users to gain access to market opportunities at any time. Automated trading has the inherent dangers. They include the risk for software errors as well as security weaknesses and loss control of trading decision making. Before using any bot to trade live trading, it's essential to thoroughly evaluate and test the bot.

Definition: RSI diversence is a analytical tool that analyzes the direction that an asset's prices move in relation to the index of relative strength (RSI).

Signal Positive RSI divergence is seen as a bullish signal, while the opposite of a negative RSI divergence is seen as bearish.

Trend Reversal: RSI Divergence can signal an inverse trend.

Confirmation: RSI divergence can be utilized as a confirmation tool when used in conjunction with other analysis methods.

Timeframe: RSI divergence may be observed at various dates to gain different insight.

Overbought/Oversold RSI numbers that exceed 70 mean overbought, and values below 30 mean that the stock is oversold.

Interpretation: To interpret RSI divergence in a correct manner requires taking into account additional fundamental and technical aspects. Follow the top rated backtesting platform for site recommendations including forex tester, forex backtester, automated trading software, trading platform, cryptocurrency trading, crypto backtesting, forex trading, automated cryptocurrency trading, automated trading bot, best crypto trading platform and more.

What Is The Difference Between Regular Divergence Vs Hidden Divergence?

Regular Divergence: This occurs when the asset's price hits an upper or lower level than the RSI. It could signal the possibility of a trend reversal. But it is important to take into account the fundamental and technical aspects. Although this signal is not as powerful as regular divergence, it could still signal a possible trend reverse.

To be aware of the technical aspects:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other indicators of technical quality or oscillators

Take note of these essential aspects:

Economic data are released for release

Special news for businesses

Market sentiment and indicators of sentiment

Global developments and their impact on the market

It's essential to look at fundamental and technical aspects prior to making investment decisions that are based on RSI divergence signals. Check out the top rated online trading platform for website info including forex backtesting, backtesting platform, cryptocurrency trading bot, trading divergences, backtester, RSI divergence, trading with divergence, automated trading software, trading platform, trading platform cryptocurrency and more.

What Are The Backtesting Strategies For Trading Crypto

Backtesting crypto trading strategies is the practice of replicating the implementation of a trading plan using historical data. This allows you to assess the possibility of profit. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Explain the trading strategy that is currently being tested. This covers entry and exit rules and position sizing.

Simulator: This application allows you to simulate the implementation of a trading plan using historical data. This lets you see how the strategy would perform over time.

Metrics - Assess the strategy's performance using metrics such as Sharpe Ratio, Profitability drawdown, Sharpe Ratio, as well as other pertinent measures.

Optimization: Modify the strategy's parameters and run the simulation once more to improve the strategy's performance.

Validation: To ensure the method is dependable and avoid overfitting, verify its performance on data outside of sample.

Remember that past performance does not necessarily guarantee future results. Results from backtesting are not a guarantee of future profits. When applying the strategy to live trading, it's important to take into account the market's volatility, transaction costs, and other real-world considerations. Check out the most popular automated trading bot for more info including trading platforms, cryptocurrency trading, crypto backtesting, best trading platform, crypto backtesting, trading platform cryptocurrency, forex backtesting software free, crypto trading, position sizing calculator, crypto trading and more.

What Can You Do To Review The Forex Backtesting Software When Trading With Divergence

The following elements must be considered when evaluating forex backtesting programs to trade using RSI divergence. Data Accuracy: Ensure that the program has access to quality historical data for the forex pairs traded.

Flexible: The software should allow for customizing and testing of various RSI trading strategies for divergence.

Metrics : The program should include a range o metrics to evaluate the performance RSI Divergence Strategies for Trading, including the profitability, risk/reward and drawdown.

Speed: Software must be quick and efficient to enable rapid backtesting of different strategies.

User-Friendliness: The program should be user-friendly and easy to comprehend, even for people who do not have a deep understanding of technical analysis.

Cost: You should take a look at the cost of the program to determine if it is within your budget.

Support: You need good customer support. This includes tutorials and technical support.

Integration: The program should work well with other tools used in trading, such as trading platforms and charting software.

It's important to try out the software with the demo account prior to committing to a monthly subscription to ensure it's suited to your needs specifically and you're comfortable with the software. Check out the top position sizing calculator for website info including automated forex trading, crypto backtesting, best crypto trading platform, forex backtest software, cryptocurrency trading bot, backtesting platform, trading with divergence, divergence trading, backtesting strategies, crypto trading and more.

What Is The Process By Which Cryptocurrency Trading Software Bots Work?

A set of pre-determined rules are implemented by crypto trading robots which make trades for the user. Here's how it works. Trading Strategy: The user designs a trading strategy that includes entry and exit rules, the size of the position as well as risk management guidelines and risk management.

Integration: The robot for trading is integrated with a cryptocurrency platform through APIs. This lets it gain access to real-time market information and execute trades.

Algorithm: The bot employs algorithms to analyse market data and make decisions in accordance with the trading strategy.

Execution. The bot makes trades according to the trading strategy. It doesn't need manual intervention.

Monitoring The trading bot continually is monitoring and adapting to the market as necessary. Follow the top rated trading divergences for blog advice including bot for crypto trading, best trading platform, RSI divergence, forex backtest software, trading with divergence, forex tester, divergence trading, divergence trading forex, best crypto trading platform, forex backtesting software free and more.

Automated trading using cryptocurrency is extremely beneficial. They can execute complex and repetitive trading strategies, without the necessity of human intervention. They also allow users to gain access to market opportunities at any time. Automated trading has the inherent dangers. They include the risk for software errors as well as security weaknesses and loss control of trading decision making. Before using any bot to trade live trading, it's essential to thoroughly evaluate and test the bot.