Best Facts For Deciding On Trade RSI Divergence

4 Best Suggestions For Selecting An RSI Divergence Strategy?

Let's start with the obvious question. Let's examine the what RSI Divergence looks like and what trading clues can be learned from it. If the price action and RSI indicator are not in accord on your chart, it is a divergence. Which mean, in an economy that is in a downtrend price makes a lower low But the RSI indicator is able to make higher lows. The indicator might not be in agreement with price action and there is a possibility of a divergence when it does not. Be aware of the market whenever an event occurs. The chart clearly shows bullish RSI divignance as well as bearish RSI divigence. In this way, the price action reversed immediately following each RSI divergence signal. Let's look at one final issue before proceeding to the exciting topic. Check out the top divergence trading forex for website tips including forex robot forex, webull automatic investment, rsi divergence trader, forex trading tools, auto buy sell signal indicator tradingview, copykat autotrading system, introduction to algorithmic trading strategies, breakout indicator mt4, forex 4 money, gold and forex, and more.

What Is The Best Way To Analyze Rsi Divergence?

We employ the RSI indicator to help to identify trends reversals. But, it is essential to determine the most appropriate trend reversal.

How To Identify Rsi Divergence In Forex Trading

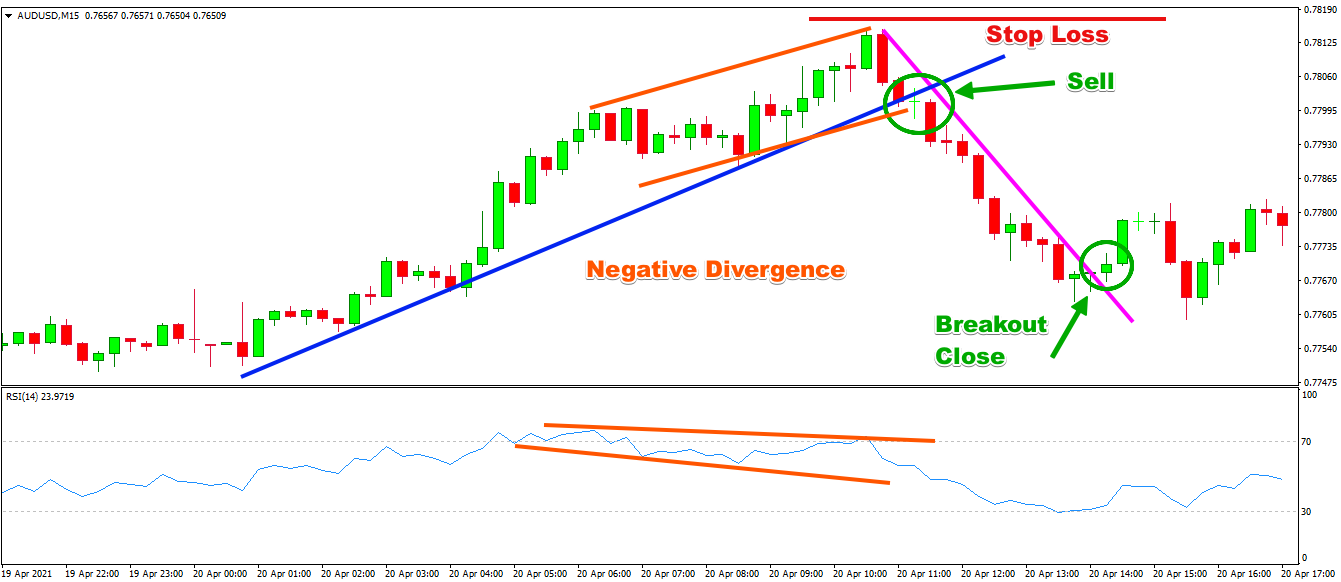

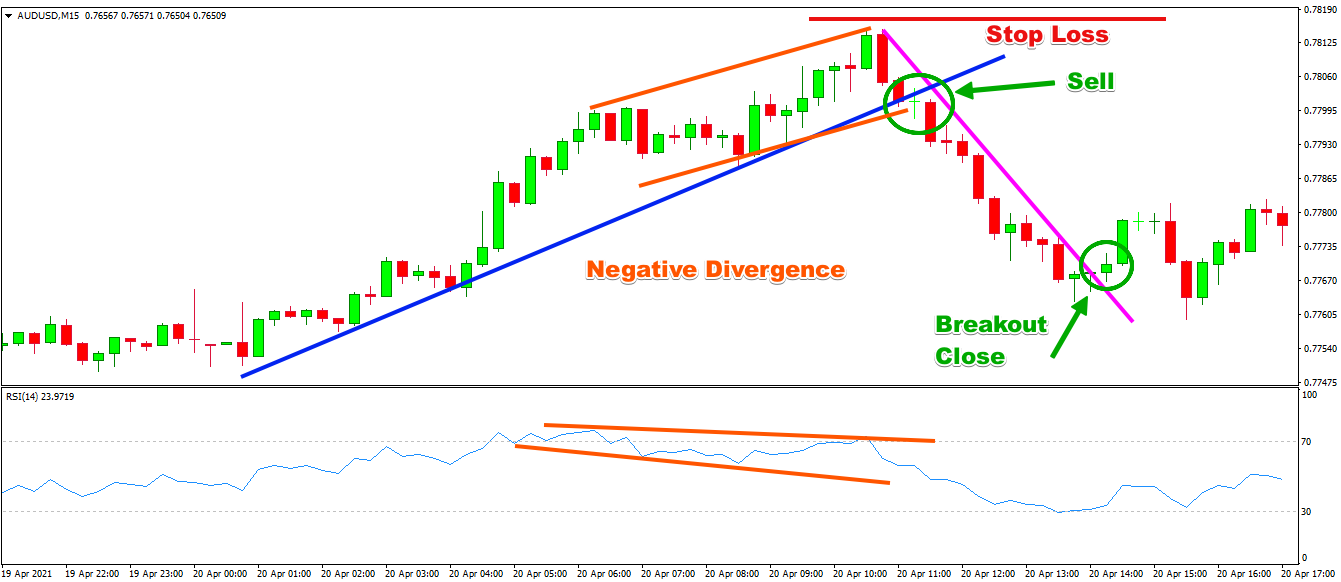

Both Price Action (RSI indicator) and Price Action (Price Action) both did exactly the same thing at the start of the trend, making higher highs. This is a sign that the trend has strength. The trend ended when Price reached higher levels at the conclusion. However, the RSI indicator reached lower highs. This indicates that this chart is one to watch. In this case, we must pay close attention to the markets as both the indicator's actions and price are outof the sync. This indicates that there is an RSI divergence. The RSI divergence here indicates a bearish trend rotation. Check out the chart to look at what happened following the RSI split. The RSI divergence can be extremely accurate when it is used to detect trends that have reversed. Now, the question is how to spot the trend reverse. Let's look at four trade entry strategies that combine RSI divergence with more likely signals. Take a look at top rated forex tester for site recommendations including price action indicator mt4, auto money trade, best forex trading robot 2020, automated forex trading program, metatrader 4 online, trader joe's crypto, best crypto exchange for altcoins, ftx trading ltd, forex investing, ctrader mac, and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Triangle chart patterns is a pattern that can be utilized in two different ways. A variation is the Ascending Triangle pattern. It is a good choice as a reversal design during the downtrend. The pattern of the descending triangle functions as an uptrend market reversal pattern. Let's look closer at the forex chart to observe the downwards-facing circle pattern. Like the earlier instance, the market was in an upward trend and then the price started to slow down. RSI is also a sign of divergence. These indicators indicate the weak points in the uptrend. It is evident that the current uptrend is losing its momentum. Price has formed a triangular pattern that resembles a downward spiral. This confirms that there is a reversal. It's now time to take action on the trade. Like in the previous instance we employed the same breakout strategies to execute this trade too. Let's now get to the third entry technique. This time , we'll pair the structure of the trend with RSI diversion. Let's see how we can trade RSI divergence when the structure of the trend is changing. Take a look at top rated automated trading platform for site info including forex trading in islam, etoro mt4, currency trading for beginners, exness trading, online cfd trading, top 30 crypto exchanges, voyager digital ltd, algo trading on robinhood, leverage trading crypto binance, forex platforms for beginners, and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI Divergence can help forex traders to identify market reversals. Combining RSI divergence together with other indicators that indicate reversals, such as the head and shoulders pattern could increase our chances of winning. That's fantastic! Let's take a examine how we can predict trades by combining RSI divergence with the Head and Shoulders pattern. Related - Trading Head and Shoulders Patterns in Forex: A Reversal Trading strategy. A favorable market environment is required before we look at trading. Since we're trying to find a trend reversal, It is preferential to have a trending market. Take a look at the chart below. Check out the best backtesting strategies for site recommendations including cryptocurrency platforms list, most popular crypto exchanges, crypto webull, iq option auto trading bot, fx cfd, divergence trading rsi, developing algorithmic trading strategies, kot4x demo, islamic forex brokers, mt4 to nest auto trading, and more.

Tip #3 – Combining RSI Diversity with the Trend Architecture

The trend is our good friend. If the market is in a trend, then we should invest in the direction of that trend. This is the way that professionals train. Trends don't last forever. It will eventually reverse. We will learn how to recognize reversals swiftly by studying the structure of the trend as well as the RSI Divergence. As we all know, uptrends are forming higher highs and downtrends lower lows. The chart below illustrates this point. The left-hand side of the chart shows a downtrend, with an array of highs and lows. Next, have a look at the RSI divergence that is highlighted in the chart (Red Line). Price action may create lows however, the RSI can create higher lows. What is this indicating? Despite the fact that the market creates low RSI it is doing the opposite. This suggests that the current downtrend is losing momentum. We should be ready to see a reversal. Have a look at the top divergence trading forex for site info including quadency bot, 4x trading, binance robot trading, automated copy trading, best automated trading software 2020, free forex signals online with real time, bot trading in binance, auto trading software for iq option, cryptocurrency exchange app, forex trading time, and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

A double top (or double bottom) is a form of reversal which occurs following a prolonged move or a trend. Double tops are formed when a price level cannot be breached. The price then reverses only a little, before returning to the prior level. If the price bounces back to the level, you'll see a double top. Below is the double top. This double top demonstrates the creation of two tops through a powerful maneuver. The second highest top didn't reach the heights of the previous. This indicates reverse. It's telling buyers that they struggle to keep climbing higher. The double bottom is built on the same principles however it uses an alternative approach. We will apply the method of entry using breakouts. So, in this case we will execute selling the trade when price has risen below the trigger line. Within a day, our profit was attained. Quick Profit. Double bottoms can be traded using the same techniques. Check out the diagram below to find out the best way to trade RSI divergence in the event of the double bottom.

Keep in mind that this is not the only strategy that works for all traders. There isn't a thing that is considered to be a perfect trading method and all the trading strategies suffer from losses and they must be dealt with. We can earn consistent profits using this strategy, but, we do have a strict risk-management method and a fast way to reduce the losses. This will allow us to cut down on drawdowns and opens the doors to huge upside possibilities. Read more- 978_f75 , and #crosslink.

Let's start with the obvious question. Let's examine the what RSI Divergence looks like and what trading clues can be learned from it. If the price action and RSI indicator are not in accord on your chart, it is a divergence. Which mean, in an economy that is in a downtrend price makes a lower low But the RSI indicator is able to make higher lows. The indicator might not be in agreement with price action and there is a possibility of a divergence when it does not. Be aware of the market whenever an event occurs. The chart clearly shows bullish RSI divignance as well as bearish RSI divigence. In this way, the price action reversed immediately following each RSI divergence signal. Let's look at one final issue before proceeding to the exciting topic. Check out the top divergence trading forex for website tips including forex robot forex, webull automatic investment, rsi divergence trader, forex trading tools, auto buy sell signal indicator tradingview, copykat autotrading system, introduction to algorithmic trading strategies, breakout indicator mt4, forex 4 money, gold and forex, and more.

What Is The Best Way To Analyze Rsi Divergence?

We employ the RSI indicator to help to identify trends reversals. But, it is essential to determine the most appropriate trend reversal.

How To Identify Rsi Divergence In Forex Trading

Both Price Action (RSI indicator) and Price Action (Price Action) both did exactly the same thing at the start of the trend, making higher highs. This is a sign that the trend has strength. The trend ended when Price reached higher levels at the conclusion. However, the RSI indicator reached lower highs. This indicates that this chart is one to watch. In this case, we must pay close attention to the markets as both the indicator's actions and price are outof the sync. This indicates that there is an RSI divergence. The RSI divergence here indicates a bearish trend rotation. Check out the chart to look at what happened following the RSI split. The RSI divergence can be extremely accurate when it is used to detect trends that have reversed. Now, the question is how to spot the trend reverse. Let's look at four trade entry strategies that combine RSI divergence with more likely signals. Take a look at top rated forex tester for site recommendations including price action indicator mt4, auto money trade, best forex trading robot 2020, automated forex trading program, metatrader 4 online, trader joe's crypto, best crypto exchange for altcoins, ftx trading ltd, forex investing, ctrader mac, and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Triangle chart patterns is a pattern that can be utilized in two different ways. A variation is the Ascending Triangle pattern. It is a good choice as a reversal design during the downtrend. The pattern of the descending triangle functions as an uptrend market reversal pattern. Let's look closer at the forex chart to observe the downwards-facing circle pattern. Like the earlier instance, the market was in an upward trend and then the price started to slow down. RSI is also a sign of divergence. These indicators indicate the weak points in the uptrend. It is evident that the current uptrend is losing its momentum. Price has formed a triangular pattern that resembles a downward spiral. This confirms that there is a reversal. It's now time to take action on the trade. Like in the previous instance we employed the same breakout strategies to execute this trade too. Let's now get to the third entry technique. This time , we'll pair the structure of the trend with RSI diversion. Let's see how we can trade RSI divergence when the structure of the trend is changing. Take a look at top rated automated trading platform for site info including forex trading in islam, etoro mt4, currency trading for beginners, exness trading, online cfd trading, top 30 crypto exchanges, voyager digital ltd, algo trading on robinhood, leverage trading crypto binance, forex platforms for beginners, and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI Divergence can help forex traders to identify market reversals. Combining RSI divergence together with other indicators that indicate reversals, such as the head and shoulders pattern could increase our chances of winning. That's fantastic! Let's take a examine how we can predict trades by combining RSI divergence with the Head and Shoulders pattern. Related - Trading Head and Shoulders Patterns in Forex: A Reversal Trading strategy. A favorable market environment is required before we look at trading. Since we're trying to find a trend reversal, It is preferential to have a trending market. Take a look at the chart below. Check out the best backtesting strategies for site recommendations including cryptocurrency platforms list, most popular crypto exchanges, crypto webull, iq option auto trading bot, fx cfd, divergence trading rsi, developing algorithmic trading strategies, kot4x demo, islamic forex brokers, mt4 to nest auto trading, and more.

Tip #3 – Combining RSI Diversity with the Trend Architecture

The trend is our good friend. If the market is in a trend, then we should invest in the direction of that trend. This is the way that professionals train. Trends don't last forever. It will eventually reverse. We will learn how to recognize reversals swiftly by studying the structure of the trend as well as the RSI Divergence. As we all know, uptrends are forming higher highs and downtrends lower lows. The chart below illustrates this point. The left-hand side of the chart shows a downtrend, with an array of highs and lows. Next, have a look at the RSI divergence that is highlighted in the chart (Red Line). Price action may create lows however, the RSI can create higher lows. What is this indicating? Despite the fact that the market creates low RSI it is doing the opposite. This suggests that the current downtrend is losing momentum. We should be ready to see a reversal. Have a look at the top divergence trading forex for site info including quadency bot, 4x trading, binance robot trading, automated copy trading, best automated trading software 2020, free forex signals online with real time, bot trading in binance, auto trading software for iq option, cryptocurrency exchange app, forex trading time, and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

A double top (or double bottom) is a form of reversal which occurs following a prolonged move or a trend. Double tops are formed when a price level cannot be breached. The price then reverses only a little, before returning to the prior level. If the price bounces back to the level, you'll see a double top. Below is the double top. This double top demonstrates the creation of two tops through a powerful maneuver. The second highest top didn't reach the heights of the previous. This indicates reverse. It's telling buyers that they struggle to keep climbing higher. The double bottom is built on the same principles however it uses an alternative approach. We will apply the method of entry using breakouts. So, in this case we will execute selling the trade when price has risen below the trigger line. Within a day, our profit was attained. Quick Profit. Double bottoms can be traded using the same techniques. Check out the diagram below to find out the best way to trade RSI divergence in the event of the double bottom.

Keep in mind that this is not the only strategy that works for all traders. There isn't a thing that is considered to be a perfect trading method and all the trading strategies suffer from losses and they must be dealt with. We can earn consistent profits using this strategy, but, we do have a strict risk-management method and a fast way to reduce the losses. This will allow us to cut down on drawdowns and opens the doors to huge upside possibilities. Read more- 978_f75 , and #crosslink.