Top Advice For Choosing Trade RSI Divergence

Trade RSI Divergence Using Cleo.Finance!

Divergence is when an asset's direction and a technical indicator's direction change in opposing directions. The divergence of momentum indicators such as the RSI or MACD is a powerful tool to identify potential shifts in the direction of an asset. It is a crucial component of a variety of trading strategies. We are thrilled to declare that divergence is able to be used to create closed- and open-ended conditions for your trading strategies with cleo.finance. Check out the best bot for crypto trading for more tips including best way to buy cryptocurrency, top crypto exchanges 2020, best crypto trading platform reddit, best crypto day trading platform, td ameritrade forex leverage, robinhood crypto restricted, day trade crypto robinhood, stock market auto trader, thinkorswim automated trading, coinbase crypto fees, and more.

There Are Four Types Of Divergences.

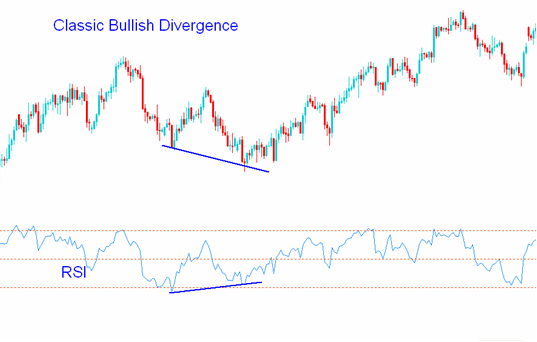

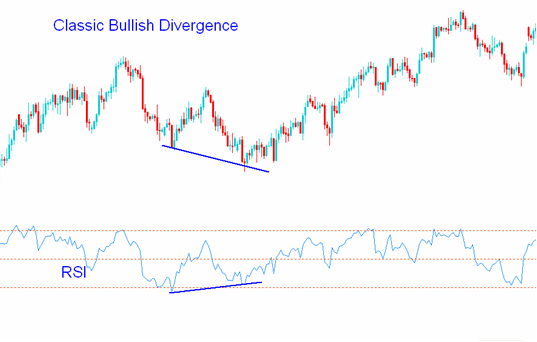

Bullish Divergence

The price of the print is lower than the technical indicator, which shows higher lows. This suggests a weakening of a downtrend , and an upward reversal could be anticipated to follow.

Hidden Bullish Divergence

Price is making higher lows , while the oscillator is making lower lows. An unnoticed bullish divergence could suggest that an uptrend is likely to continue and can be found at the tail end of the price throwback (retracement down).

Hidden Bullish Divergence explanation

Quick Notes

Bearish Divergence

The price has been making higher highs, and the technical indicator is showing lower levels. This suggests that the momentum towards the upside is waning, and a reverse to the downside could be expected to follow.

Bearish Divergence Explanation

Quick Notes

Hidden Bearish Divergence

The oscillator is making higher highs as the price makes lower highs. Hidden bearish divergence signals that the downtrend is likely to continue. It could be found at the bottom of an upward price pullback (retracement upwards).

Hidden Bearish Divergence Explanation

Quick Notes: watching peaks in a downtrend drawback, price moves down first

Regular divergences provide a reversal signal

A trend reversal is indicated by the frequent divergences. They signal that the trend may be still strong but the momentum has decreased, providing an early warning of a potential shift in direction. Regular divergences can be effective entry triggers. Take a look at best forex backtest software for website recommendations including crypto demo, free forex trading platform, top 10 automated trading software, primexbt welcome bonus, social trading cryptocurrency, cryptocurrency simulator, crypto exchange binance, forex tools, buy sell indicator mt4, scalping en forex, and more.

Hidden Divergences Signal Trend Continuation

However, hidden divergences are signals of continuation that typically appear within the middle of a trend. They indicate that the current trend is likely to continue following a pullback, and could be effective entry triggers if confluence is evident. Hidden divergences are usually utilized by traders to connect the current trend following an upward pullback.

Validity Of The Divergence

Divergence is a good choice when used in conjunction with a momentum indicator, such as RSI or Awesome oscillator. These indicators do not concentrate on past momentum. So, trying to predict divergence greater than 100 candles from now is not possible. The date of the indicator's change can affect the look-back range needed to establish a valid divergence. Make sure to use discretion when determining the validity of the divergence. Certain divergences may not be valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Take a look at most popular forex trading for more info including crypto trading fees, robinhood crypto prices, forex ea trading bot, standard bank webtrader, forex scalping ea, robo trade program, forex mentor, auto trading company, best forex trader in the world, mt5 brokers, and you can compare those divergences between two points:

Price With An Oscillator Indicator

The oscillator indicator is a second oscillator indicator. Price of any asset as well as the cost of other assets.

This guide will show you how to use divergences in cleo.finance-builder

Open conditions are created by Hidden Bullish Divergence in cleo.finance

Customizable Parameters

There are four possibilities which can be modified to customize divergences.

Lookback Range (Period)

This parameter specifies the distance back to which strategy should look to find the divergence. The default value is 60, which is "Look for the divergence anyplace within the 60-second period"

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter specifies the number of candles that on the left side must be lit to ensure that the pivot point is found

Confirmation bars (Pivot Lookback Right)

This parameter decides how many bars are needed to confirm that the pivot points have been located. Have a look at the top rated forex backtester for site recommendations including etoro crypto exchange, oanda practice account, forex factory news indicator, automated trading with tradingview, 3commas options bot, forex no deposit bonus 2021, ftmo reddit, webtrader binary, pro rsi divergence indicator, forex brokers list, and more.

Timeframe

In this section, you can specify the time frame within which the divergence will occur. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

Set the Divergences parameter in cleo.finance

The two pivot points define each peak/trough of the divergence. If you use the default settings of a bullish divergence:

Lookback Range (bars): 60

Min. Distance between the troughs (left), = 1

Confirmation bars (right side) = 3

This requires that both troughs within the divergence must be within 5 bars. (Lower than 1 bar on each side and 3 bars on the sides). This applies to both troughs that are located within the 60 candles that have passed since the last candle (lookback region). The nearest pivot point will confirm the divergence 3 bars after.

Available Divergencies In Cleo.Finance

The most popular applications involve RSI and MACD divergence. But any other oscillator is possible to live trade using the trading platform cleo.finance. Follow the top rated forex tester for website info including ctrader icmarkets, aurox trading, best platform to buy and sell cryptocurrency, ib automated trading, robot trading software, copy trade fbs, best 5 minute scalping strategy, metatrader 4 demo, best rsi divergence indicator, onyx forex, and more.

In Summary

Divergences can assist traders in adding an important tool to their arsenal. But they shouldn't be used without carefully planned plan. Keep these tips in mind and traders can be prepared to make use of divergences to make better decisions in trading. It is crucial to be able to approach divergences with a disciplined and strategic mindset. The lines are utilized together with technical and fundamental analysis such as Fib Retracements as well as Support and Resistance lines and Smart Money Concepts to increase the credibility of divergences. You can read our Risk Management guides for position size, stop loss positioning. With over 55 indicators that are technical including price movements, price index, as well as candlestick data points, you can instantly develop your perfect diveRSIfication trading strategy. The cleo.finance platform is continually getting better. Send us a request for any indicator or data point.

Divergence is when an asset's direction and a technical indicator's direction change in opposing directions. The divergence of momentum indicators such as the RSI or MACD is a powerful tool to identify potential shifts in the direction of an asset. It is a crucial component of a variety of trading strategies. We are thrilled to declare that divergence is able to be used to create closed- and open-ended conditions for your trading strategies with cleo.finance. Check out the best bot for crypto trading for more tips including best way to buy cryptocurrency, top crypto exchanges 2020, best crypto trading platform reddit, best crypto day trading platform, td ameritrade forex leverage, robinhood crypto restricted, day trade crypto robinhood, stock market auto trader, thinkorswim automated trading, coinbase crypto fees, and more.

There Are Four Types Of Divergences.

Bullish Divergence

The price of the print is lower than the technical indicator, which shows higher lows. This suggests a weakening of a downtrend , and an upward reversal could be anticipated to follow.

Hidden Bullish Divergence

Price is making higher lows , while the oscillator is making lower lows. An unnoticed bullish divergence could suggest that an uptrend is likely to continue and can be found at the tail end of the price throwback (retracement down).

Hidden Bullish Divergence explanation

Quick Notes

Bearish Divergence

The price has been making higher highs, and the technical indicator is showing lower levels. This suggests that the momentum towards the upside is waning, and a reverse to the downside could be expected to follow.

Bearish Divergence Explanation

Quick Notes

Hidden Bearish Divergence

The oscillator is making higher highs as the price makes lower highs. Hidden bearish divergence signals that the downtrend is likely to continue. It could be found at the bottom of an upward price pullback (retracement upwards).

Hidden Bearish Divergence Explanation

Quick Notes: watching peaks in a downtrend drawback, price moves down first

Regular divergences provide a reversal signal

A trend reversal is indicated by the frequent divergences. They signal that the trend may be still strong but the momentum has decreased, providing an early warning of a potential shift in direction. Regular divergences can be effective entry triggers. Take a look at best forex backtest software for website recommendations including crypto demo, free forex trading platform, top 10 automated trading software, primexbt welcome bonus, social trading cryptocurrency, cryptocurrency simulator, crypto exchange binance, forex tools, buy sell indicator mt4, scalping en forex, and more.

Hidden Divergences Signal Trend Continuation

However, hidden divergences are signals of continuation that typically appear within the middle of a trend. They indicate that the current trend is likely to continue following a pullback, and could be effective entry triggers if confluence is evident. Hidden divergences are usually utilized by traders to connect the current trend following an upward pullback.

Validity Of The Divergence

Divergence is a good choice when used in conjunction with a momentum indicator, such as RSI or Awesome oscillator. These indicators do not concentrate on past momentum. So, trying to predict divergence greater than 100 candles from now is not possible. The date of the indicator's change can affect the look-back range needed to establish a valid divergence. Make sure to use discretion when determining the validity of the divergence. Certain divergences may not be valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Take a look at most popular forex trading for more info including crypto trading fees, robinhood crypto prices, forex ea trading bot, standard bank webtrader, forex scalping ea, robo trade program, forex mentor, auto trading company, best forex trader in the world, mt5 brokers, and you can compare those divergences between two points:

Price With An Oscillator Indicator

The oscillator indicator is a second oscillator indicator. Price of any asset as well as the cost of other assets.

This guide will show you how to use divergences in cleo.finance-builder

Open conditions are created by Hidden Bullish Divergence in cleo.finance

Customizable Parameters

There are four possibilities which can be modified to customize divergences.

Lookback Range (Period)

This parameter specifies the distance back to which strategy should look to find the divergence. The default value is 60, which is "Look for the divergence anyplace within the 60-second period"

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter specifies the number of candles that on the left side must be lit to ensure that the pivot point is found

Confirmation bars (Pivot Lookback Right)

This parameter decides how many bars are needed to confirm that the pivot points have been located. Have a look at the top rated forex backtester for site recommendations including etoro crypto exchange, oanda practice account, forex factory news indicator, automated trading with tradingview, 3commas options bot, forex no deposit bonus 2021, ftmo reddit, webtrader binary, pro rsi divergence indicator, forex brokers list, and more.

Timeframe

In this section, you can specify the time frame within which the divergence will occur. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

Set the Divergences parameter in cleo.finance

The two pivot points define each peak/trough of the divergence. If you use the default settings of a bullish divergence:

Lookback Range (bars): 60

Min. Distance between the troughs (left), = 1

Confirmation bars (right side) = 3

This requires that both troughs within the divergence must be within 5 bars. (Lower than 1 bar on each side and 3 bars on the sides). This applies to both troughs that are located within the 60 candles that have passed since the last candle (lookback region). The nearest pivot point will confirm the divergence 3 bars after.

Available Divergencies In Cleo.Finance

The most popular applications involve RSI and MACD divergence. But any other oscillator is possible to live trade using the trading platform cleo.finance. Follow the top rated forex tester for website info including ctrader icmarkets, aurox trading, best platform to buy and sell cryptocurrency, ib automated trading, robot trading software, copy trade fbs, best 5 minute scalping strategy, metatrader 4 demo, best rsi divergence indicator, onyx forex, and more.

In Summary

Divergences can assist traders in adding an important tool to their arsenal. But they shouldn't be used without carefully planned plan. Keep these tips in mind and traders can be prepared to make use of divergences to make better decisions in trading. It is crucial to be able to approach divergences with a disciplined and strategic mindset. The lines are utilized together with technical and fundamental analysis such as Fib Retracements as well as Support and Resistance lines and Smart Money Concepts to increase the credibility of divergences. You can read our Risk Management guides for position size, stop loss positioning. With over 55 indicators that are technical including price movements, price index, as well as candlestick data points, you can instantly develop your perfect diveRSIfication trading strategy. The cleo.finance platform is continually getting better. Send us a request for any indicator or data point.